Насколько безопасно хранить активы на криптобирже

7 марта 2025

Альтернативные инвестиции

7 марта 2025

На прошлой неделе мы писали, как изменения правил бухгалтерского учета для криптобирж заставили компанию Coinbase снизить стоимость активов, отраженных на балансе Coinbase, более чем в 10 раз (с $229 млрд до $22 млрд) и что это означает для клиентов компании. Теперь расскажем подробнее, как криптоиндустрия отвечает на проблемы и критику, связанные с недостаточной безопасностью клиентских средств, какие механизмы защиты она предлагает и можно ли убедиться в том, что средства на счете в криптобирже в безопасности.

Как клиенты криптобирж теряли деньги

В ноябре 2022 года криптосфера — и не только — была потрясена стремительным банкротством FTX, на тот момент третьей по величине криптобиржи, обслуживающей около 5 млн клиентов. Все началось с того, что журналисты CoinDesk опубликовали внутренние документы хедж-фонда Alameda Research, аффилированного с FTX. В результате выяснилось, что более половины средств Alameda были неликвидными токенами FTT — внутренней криптовалюты биржи FTX. Free float составлял порядка 20% от общего количества токенов, остальные контролировали FTX и Alameda.

Далее последовали заявление СЕО крупнейшей криптобиржи Binance Чанпэна Чжао (CZ) о продаже всех FTT, заморозка выводов средств клиентов FTX, блокировка аккаунтов, банкротство биржи и отставка основателя FTX Сэма Бэнкмана-Фрида, который в марте 2024 года был приговорен к 25 годам лишения свободы по обвинениям в мошенничестве.

В результате проведенного новым руководством компании аудита выяснилось, что в балансе компании существовал разрыв между активами и обязательствами в размере около $8 млрд. Помимо прочего, FTX тайно переводила средства клиентов Alameda Research, где те использовались как обеспечение для займов и трейдинга. Как подчеркнул назначенный кризисный управляющий Джон Рэй (по совпадению он же ранее разбирал банкротство Enron), «не было никакой сегрегации клиентских денег» и не велось должного учета. Фактически клиентские средства бесконтрольно смешивались с денежными потоками компании.

Крах FTX — не исключительный случай. QuadrigaCX — канадская биржа, где единственный владелец имел полный контроль над ключами. После его внезапной смерти в декабре 2018 года обнаружилось отсутствие записей ключей, а также то, что средства пользователей и компании не были разделены. Значительная часть криптоактивов была выведена основателем на личные счета и утрачена. Биржа оказалась классической схемой Понци, а пользователи потеряли около $190 млн.

В 2014 году крупнейшая на тот момент биткоин-биржа Mt. Gox потерпела крах после взломов и пропажи около 650 тысяч биткоинов, что на момент банкротства составляло примерно $480 млн. Позже выяснилось, что Mt. Gox хранила биткоины клиентов единым пулом и не разделяла по аккаунтам; не было достаточного количества холодных (офлайн) кошельков, и большая часть средств оставалась в горячих кошельках онлайн. Такое «пуловое» хранение означало, что клиенты не имели юридически обособленных монет — при банкротстве их требования смешались с остальными кредиторами. Судебные процессы затянулись на годы, и лишь спустя десятилетие кредиторы MT. Gox начали получать выплаты в счет возврата своих средств.

Какие уроки вынесла криптосфера после банкротства FTX

После краха FTX и последовавшей критики главы крупных криптобирж публично заверяли в сохранности клиентских средств, пытаясь дистанцироваться от FTX.

Так, CEO Binance Чанпэн Чжао регулярно подчеркивал, что биржа не трогает средства клиентов, проводя четкую линию между Binance и случаем FTX. Представители Binance уточняли, что биржа «не использует, не торгует и не отдает в кредит клиентские активы». После краха FTX Binance первой опубликовала адреса своих кошельков — любой человек мог посмотреть в блокчейне, сколько активов на кошельках Binance. «Лучший способ восстановить доверие — это прозрачность», — написал тогда Чжао. Такие заявления призваны убедить клиентов, что с Binance не повторится ситуация, когда средства пропадают или используются без ведома владельцев.

Руководитель Crypto.com Крис Маршалек провел AMA-сессию, отвечая на подозрения относительно платформы. Он прямо заявил: «Мы никогда не участвовали в безответственном кредитовании, не брали сторонних рисков. Мы не хедж-фонд и не торгуем активами клиентов». По словам Маршалека, Crypto.com ведет бизнес «как обычно», средства клиентов полностью обеспечены и доступны для вывода. Эти заверения прозвучали после появления информации, что биржа по ошибке отправила $400 млн эфиром на адрес другой биржи Gate.io (которые впоследствии вернули). Маршалек объяснил, что ошибка исправлена и все средства целы.

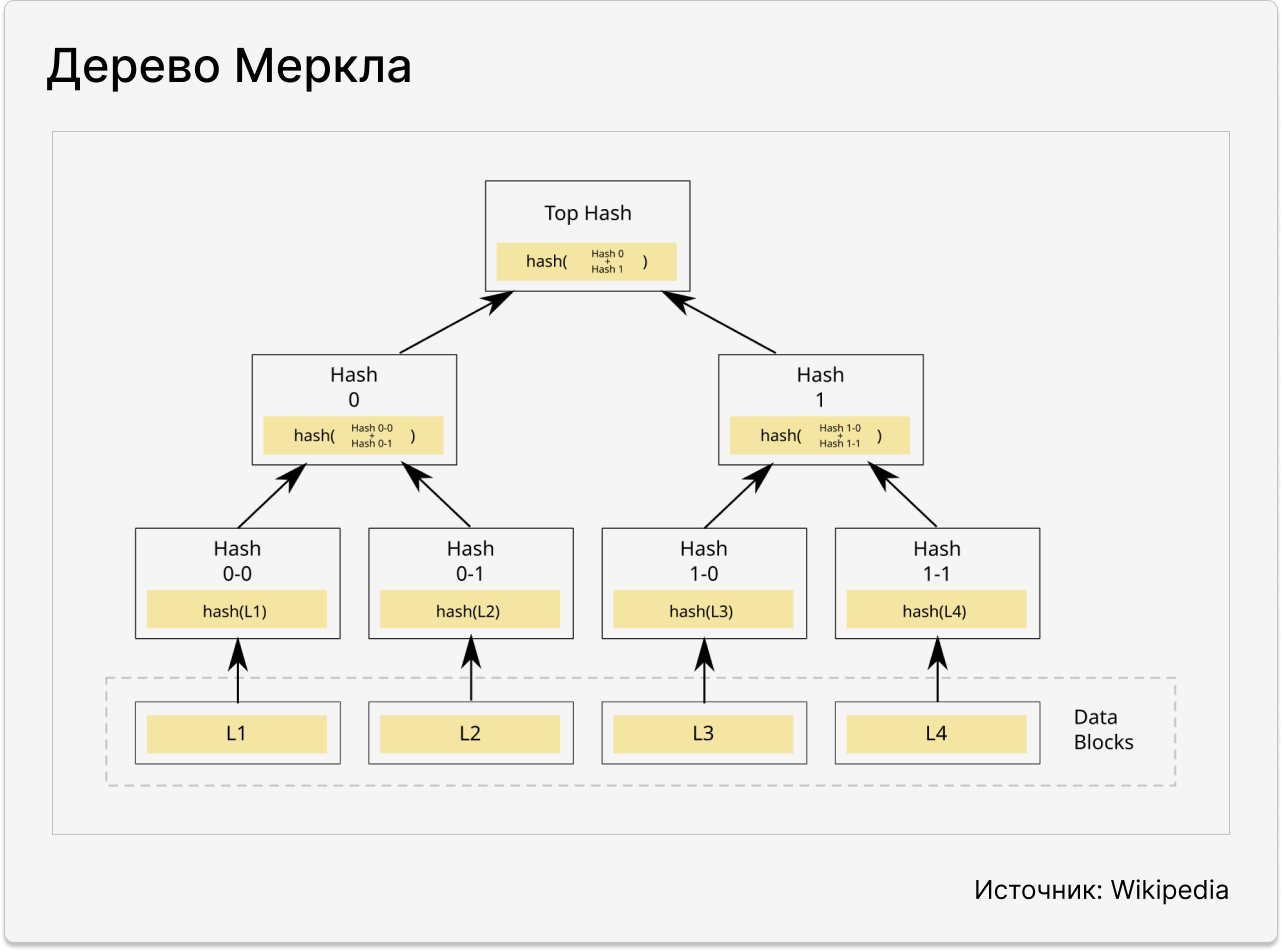

После краха FTX одним из решений для восстановления доверия стало Proof of Reserves (PoR) — «доказательство резервов» биржи. Это механизм, позволяющий клиентам и сторонним наблюдателям убедиться, что на балансах биржи имеется достаточное количество активов для покрытия всех клиентских депозитов. Ключевым техническим инструментом PoR выступает дерево Меркла (Merkle Tree) — криптографическая структура данных (хеш-дерево), которая позволяет проверить целостность большого набора данных без раскрытия персональной информации каждого клиента.

Как работает Proof of Reserves

Биржа делает снимок (snapshot) всех балансов клиентов на определенный момент и организует эти данные в виде Merkle Tree. Листья дерева — это хеши данных об индивидуальных балансах пользователей. Как правило, каждому аккаунту сопоставляется хеш, полученный из его баланса, плюс случайная «соль» для анонимности.

Затем пары хешей комбинируются и хешируются снова, формируя узлы верхних уровней. Итеративно продолжая эту процедуру, получается единый корневой хеш (Merkle Root), который криптографически представляет суммарное состояние всех счетов. Биржа публикует этот корневой хеш (например, на своем сайте) и опционально предоставляет пользователям инструмент, чтобы выдать им Merkle Proof — последовательность хешей от их собственного листа до корня.

С помощью такого доказательства каждый клиент может самостоятельно проверить, что его баланс учтен в совокупных резервах (пользователь локально пересчитывает хеши по пути дерева и сверяет полученный верхний хеш с опубликованным корнем). Если хоть один клиентский счет был бы тайно исключен или искажен, корневой хеш не совпадет — и нарушение сразу выяснится.

Параллельно биржа раскрывает информацию о своих резервах на блокчейне. Например, публикует адреса и балансы своих кошельков, как упоминалось выше.

На втором этапе PoR независимый аудитор (или сообщество) сравнивает суммарный баланс по клиентским данным (вычисленный через Merkle Tree) с совокупностью ончейн-активов биржи. В идеале эти величины должны совпадать (или резервы на блокчейн-кошельках должны быть больше). Если да — значит, у биржи достаточно активов на кошельках, чтобы покрыть все обязательства перед пользователями.

Например, крупная криптовалютная биржа OKX сообщает, что в соответствии с ее PoR клиенты могут «быть уверены, что их активы хранятся в соотношении 1:1», поскольку суммарные балансы пользователей в Merkle Tree соответствуют опубликованным данным о запасах на кошельках OKX.

Какие еще существуют аргументы в защиту сохранности криптоактивов на биржах

Сегрегация означает, что биржа удерживает пользовательские средства отдельно от собственных операционных счетов, зачастую на специальных кастодиальных аккаунтах или трастовых счетах, сохранность которых обеспечивает третья сторона. Сегрегация гарантирует, что в случае банкротства или долгов биржи клиентские активы не будут использованы для расчета по ее обязательствам. Например, Coinbase хранит криптоактивы через отдельную кастодиальную компанию Coinbase Custody, имеющую фидуциарный статус в штате Нью-Йорк. Он означает, что компания должна действовать в интересах клиентов, а не в своих собственных.

Вот как еще биржи должны обеспечивать безопасность клиентских средств.

1. Холодное хранение и кибербезопасность. Биржи стараются хранить основную долю криптовалют в холодных кошельках (офлайн), вне доступа через интернет. Лишь небольшой процент держится в горячих кошельках для оперативных выводов. Такая архитектура (например, ~95% средств в холодном хранении) уменьшает вероятность кражи при взломе. Именно отсутствие достаточного холодного хранения сыграло роковую роль в банкротстве Mt. Gox — большая часть биткоинов находилась онлайн и была украдена, тогда как офлайн-запасов не хватило, чтобы вернуть их клиентам после взлома. Сейчас почти все крупные биржи имеют многоуровневую систему кошельков: горячие — для малых сумм и ежедневных операций, теплые — для промежуточных сумм, cold wallets — для основной массы.

2. Мультиподпись (multisig) — еще один стандарт: доступ к кошелькам распределен между несколькими сотрудниками, чтобы ни один человек не мог единолично вывести активы. Это защищает и от внешних атак, и от внутренних злоупотреблений или утери ключа. Печальный пример обратного — QuadrigaCX, где пароли держал только один владелец, а после его смерти компания потеряла доступ ко всем холодным кошелькам.

3. Страховые фонды и полисы. Многие биржи создают резервы для покрытия непредвиденных потерь пользователей. Например, Binance еще в 2018 году учредила фонд SAFU (Secure Asset Fund for Users) — специальный страховой резерв, куда отчисляется часть комиссий. Размер фонда превышает $1 млрд. Эти средства хранятся на отдельных холодных кошельках и предназначены для компенсации пользователям ущерба в экстренных случаях. Binance уже использовала SAFU, чтобы покрыть убытки от хакерской атаки в 2019 году.

Coinbase, в свою очередь, заявляет о крупнейшей страховой программе от криминальных рисков, покрывающей кражу цифровых активов с горячих кошельков. Впрочем, точная сумма покрытия и информация о страховщике не раскрываются публично. Но этот полис не покрывает убытки, связанные с несанкционированным доступом к личным аккаунтам пользователей из-за утраты или компрометации их учетных данных.

Что делают регуляторы в разных странах

После краха FTX Комиссия по ценным бумагам и биржам SEC начала активно проверять криптофирмы, в первую очередь криптобиржи, на соблюдение принципов сохранности активов. Например, в январе и феврале 2023 года были инициированы расследования против сервисов Kraken и Gemini Earn, позволявших пользователям зарабатывать проценты на криптовалютных активах, так как они, по мнению SEC, могли нарушать законы о ценных бумагах и предлагались без соответствующей регистрации.

Вот как обстоят дела в других странах:

В Австралии и Сингапуре регуляторы тоже предложили новые правила, требующие от криптоплатформ разделения клиентских средств и периодической отчетности о запасах. В Европейском союзе в мае 2023 года принят всеобъемлющий регламент MiCA (Markets in Crypto-Assets), вступающий в силу поэтапно в 2024–2025 годах. Он прямо обязывает провайдеров криптоуслуг (CASP) обеспечить разделение клиентских криптоактивов от собственных фондов компании и проводить регулярные аудиты на предмет сохранности клиентских средств.Великобритания в 2023 году запустила набор нормативов о применении правил защиты клиентских денег (Client Money Rules) к криптоактивам — по аналогии с тем, как регулируются форекс-дилеры или брокеры (они обязаны держать средства клиентов на отдельных трастовых счетах в банковской системе).В Японии уже действует строгая модель, введенная после банкротства Mt. Gox и кибератаки на еще одну криптобиржу Coincheck в 2018 году. Биржи обязаны хранить клиентские криптовалюты под контролем внешнего доверительного банка или траста, а собственные токены должны быть отделены. К примеру, FTX Japan в итоге смогла вернуть клиентам средства, так как местные требования заставляли держать их на трастовом счету.В ОАЭ принят регламент VARA, требующий от кастодианов регулярно подтверждать резервы и иметь план на случай краха.

На что все равно обратить внимание

Клиенты криптобирж могут использовать для хранения криптоактивов некастодиальные (самостоятельные) кошельки, когда приватные ключи находятся только у пользователя. Существуют аппаратные кошельки (Ledger, Trezor), программные кошельки (MetaMask, Trust Wallet) или даже бумажные. Тут принцип простой: кто контролирует ключ, тот контролирует и саму криптовалюту на блокчейне.

Если у вас записана сид-фраза и закрытый ключ от адреса, то только вы решаете, куда перевести средства; никакая биржа не может их заморозить или присвоить. Даже если завтра закроется любая биржа или сервис, ваши BTC/ETH останутся на вашем адресе и вы сможете распоряжаться ими через блокчейн. Также уменьшается риск глобальных взломов: массово взломать тысячи индивидуальных кошельков труднее, чем один крупный горячий кошелек биржи.

Но у такого хранения есть очевидные минусы — ответственность за сохранность лежит целиком на владельце. Нужно самому озаботиться надежным хранением ключа (резервные копии офлайн, защита от потери и кражи). Если вы потеряете приватный ключ или сид-фразу, то восстановить доступ практически невозможно — монеты останутся навсегда «висячими» в блокчейне.

Поделиться